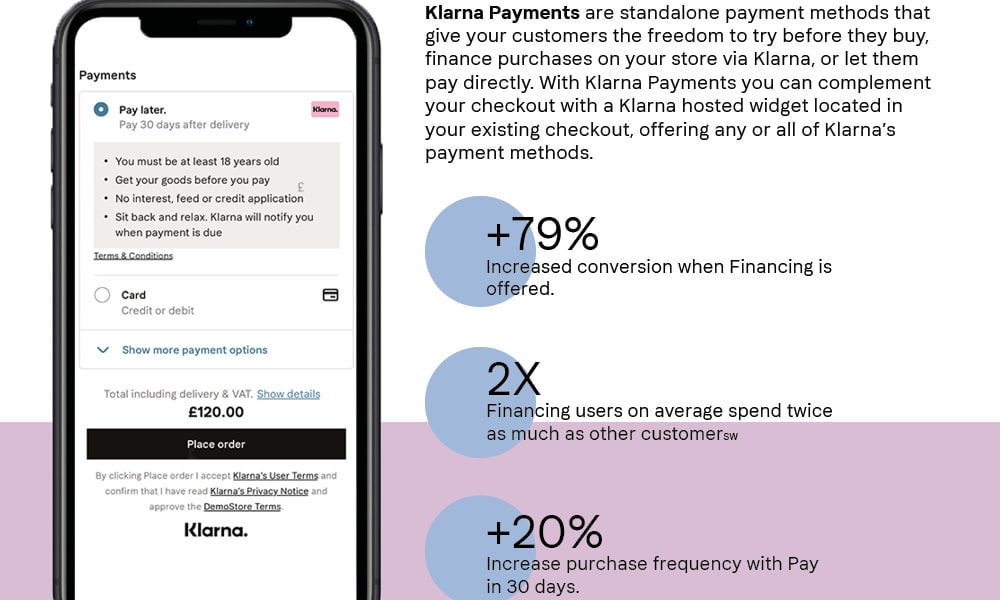

Pay With Klarna

Each of the 4 subsequent instalments will be due and payable on the same day within the weeks following. Pay immediately along with your card or bank account and all the time maintain full management over your purchases. The order is activated by the retailer and the customer’s cost interval begins. We’ll deal with accumulating the remainder from the patron.

When you select Klarna at checkout, you’ll get the option to buy now and pay later for your buy. Your account minimum fee phrases will then apply. To avoid paying any curiosity in your BNPL balance, merely pay the complete quantity by the tip of the BNPL interval however the extra you pay off, the less interest you will pay. We will contact you earlier than the top of the BNPL period to advise you of your options. Buy Now Pay Later is just out there on our website or App. BNPL permits you to pay nothing for a specified interval when you’ve an order of £100 or more.

Splash Into Scorching Lady Summer Season With Plts New Swimwear Assortment

You pays through credit or debit card in Klarna.app or by logging into /uk. Once boohoo has received the return and Klarna have obtained our confirmation, Klarna shall refund any payments collected and cancel any future scheduled funds. Although Pay later in 3 is broadly promoted it’s not always universally available. Items purchased with Klarna follow our normal return process. Please observe, refunds for Klarna purchases will be refunded from Yours Clothing to Klarna.

Is Oxipay the same as Afterpay?

Oxipay – now universally known as Humm – is a BNPL service similar to Afterpay. You can shop online and in-store with accredited vendors, repaying your merchandise in 5 to 10 instalments. Unlike Afterpay, Humm empowers consumers to spend as much as $30,000. The service refers to those items as Big Things.

While BNPL preparations are typically free if funds are made on time, critics argue they danger encouraging excessive borrowing and storing up debt issues for the longer term. Not all customers are conscious they are borrowing at all. No credit checks, and no curiosity or charges whenever you pay on time. Unlike Klarna, it does levy you miss a fee. But it’s a payment of simply £6, and the fees are capped at £24.

What If I Cant Pay An Clearpay Installment?

For example, if Your Limit is £60 and the Purchase Price is £80, on the date of purchase you will pay £20 and on every of the five remaining instalment dates you will pay £12. Subject to clause four.2, you should pay us the Purchase Price for every Product or Service you buy from us utilizing the Platform in six equal weekly instalments. The first instalment will be due and payable on the time you purchase the Product or Service. The second instalment might be due and payable on the date that is one week after the date of purchase .

Does Klarna pay four credit checks?

In order to ensure you're capable of Pay in 4, we run a delicate credit examine. A gentle credit score verify doesn’t affect your rating, it simply helps us verify that you just pay your payments on time. Note: if you use our Financing option (currently out there with select retailers), we'll run a hard credit verify.

You can log in to your Clearpay account anytime to view your payment schedule or make a cost before the following due date. Laybuy performs a credit score verify to acquire a credit rating on all new customers upon registration. Once your credit rating has been confirmed and your account has been verified, Laybuy assigns your Laybuy limit and you may start shopping instantly. The first payment equal to 1 sixth of the purchase value occurs once your order is accomplished.

So you won’t be charged more than four late fees for anyone mortgage. However some lenders, similar to Laybuy, do carry out ‘hard’ credit checks. And these do leave a ‘footprint’ on your file and could affect your score, and skill to be accepted for a mortgage, in case you are shown to have made a number of credit functions in a brief area of time. At Save the Student, we’re all about helping you save, make and handle your cash. It’s maybe no surprise, then, that we’re not huge fans of buying with buy now, pay later providers.

Can I pay in installments at Target?

Apply with Affirm to get began. Then, store online at Target.com, choose Affirm because the payment method at checkout and pick the month-to-month cost schedule that works for you. You'll never pay greater than you agreed at checkout as Affirm doesn't charge any late or hidden fees.